German Economy 2024: Macroeconomic Analysis

Executive Summary

Germany, Europe’s largest economy and a global industrial powerhouse, is navigating a complex economic landscape marked by modest growth, inflationary pressures, and significant geopolitical challenges. Despite a resilient labor market and strong export sector, the economy faces headwinds from global supply chain disruptions, energy insecurity, and demographic shifts. The government’s focus on transitioning to renewable energy under the Energiewende(energy transition) policy aims to position Germany as a leader in sustainability, but it also poses challenges in terms of cost and energy security. In the short term, tighter monetary policy by the European Central Bank to control inflation may further constrain growth. However, Germany’s strong fiscal foundation and commitment to innovation provide a robust platform for overcoming these obstacles and maintaining its economic leadership. This analysis explores the current economic conditions, key challenges, and future outlook for Germany as it strives to balance economic stability with sustainable growth.

German Economy Outlook

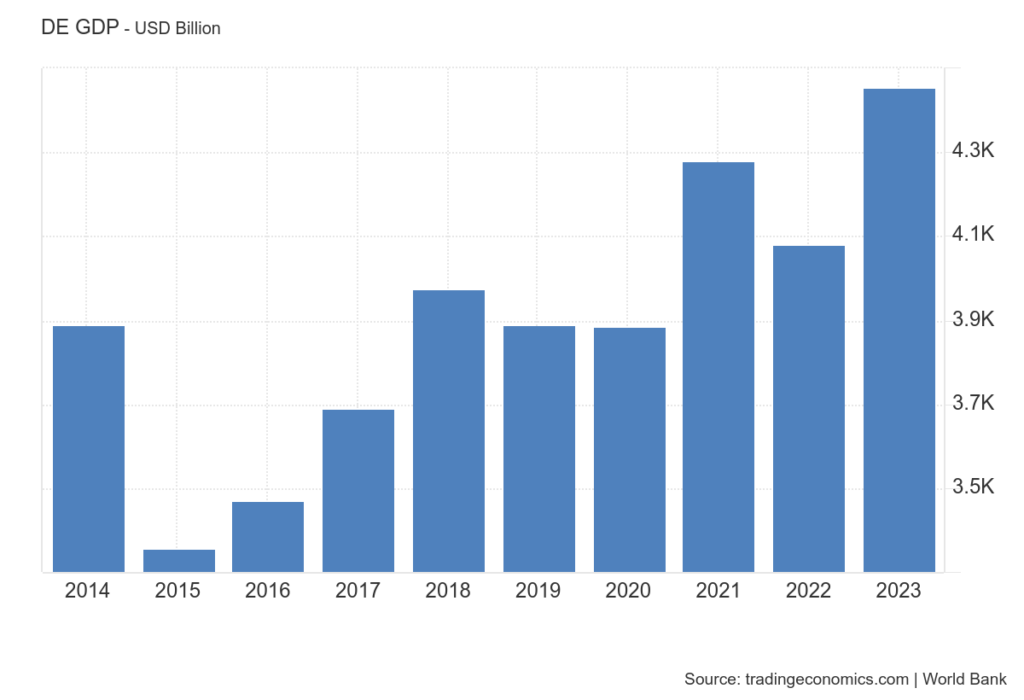

Germany is the third largest economy in the world by nominal GDP, estimated at $4.45 trillion, following the United States and China.

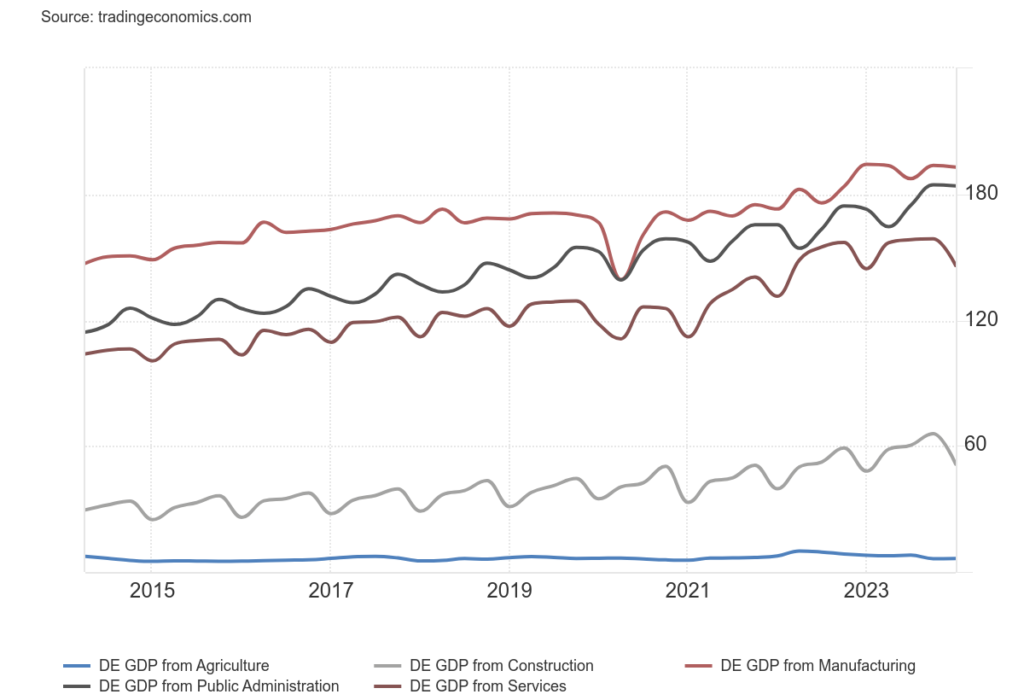

The main pillar of Germany’s growth is its manufacturing sector, which contributes nearly 20% of the total GDP, amounting to 190 billion EUR in Q1 2024. Automotive and chemical production are the backbone of this sector.

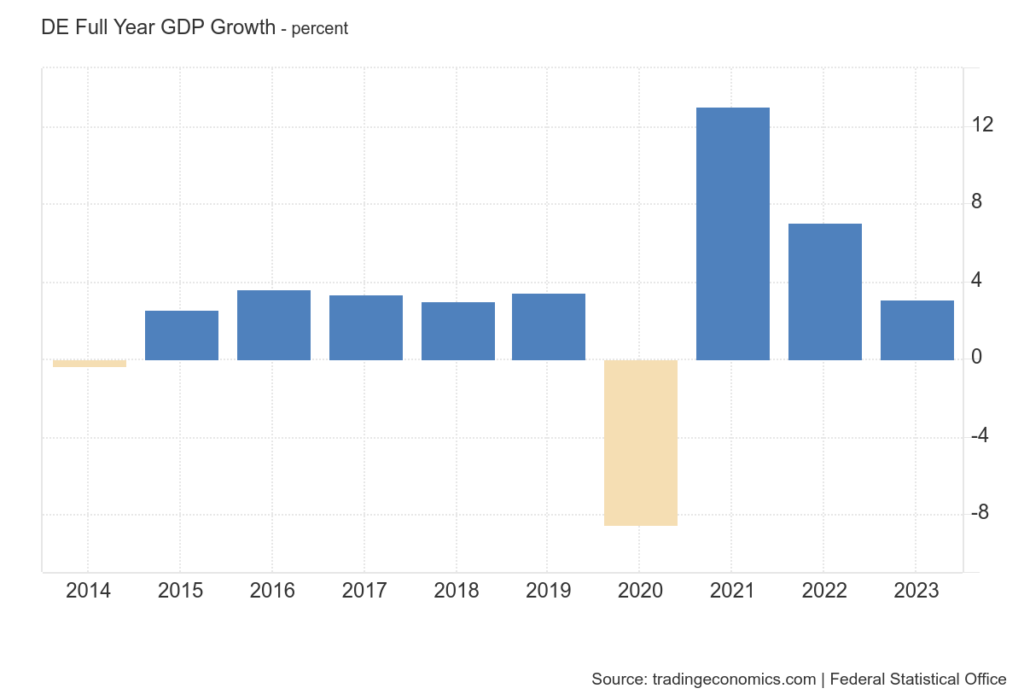

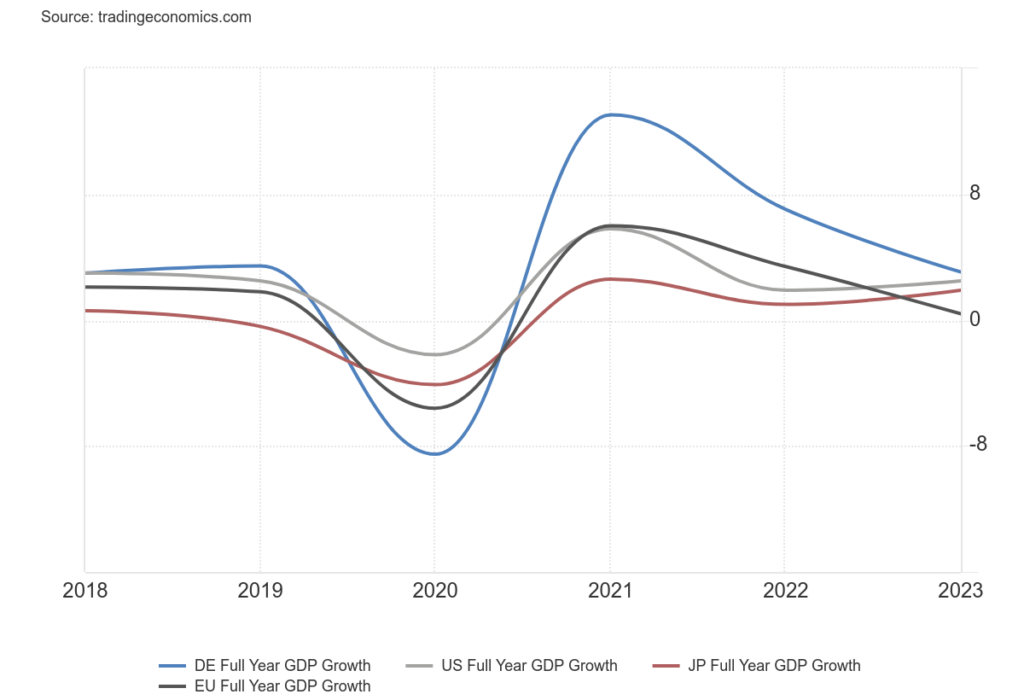

In 2020, the German economy faced a significant downturn of -8.5% due to the pandemic. However, a rapid recovery followed, with a 13% growth rate in the subsequent year. For developed countries, a growth rate of 2-3% is considered normal. Post-pandemic, the growth rates have normalized to these levels.

All developed countries and the European Union faced similar challenges during the pandemic, followed by a swift economic recovery.

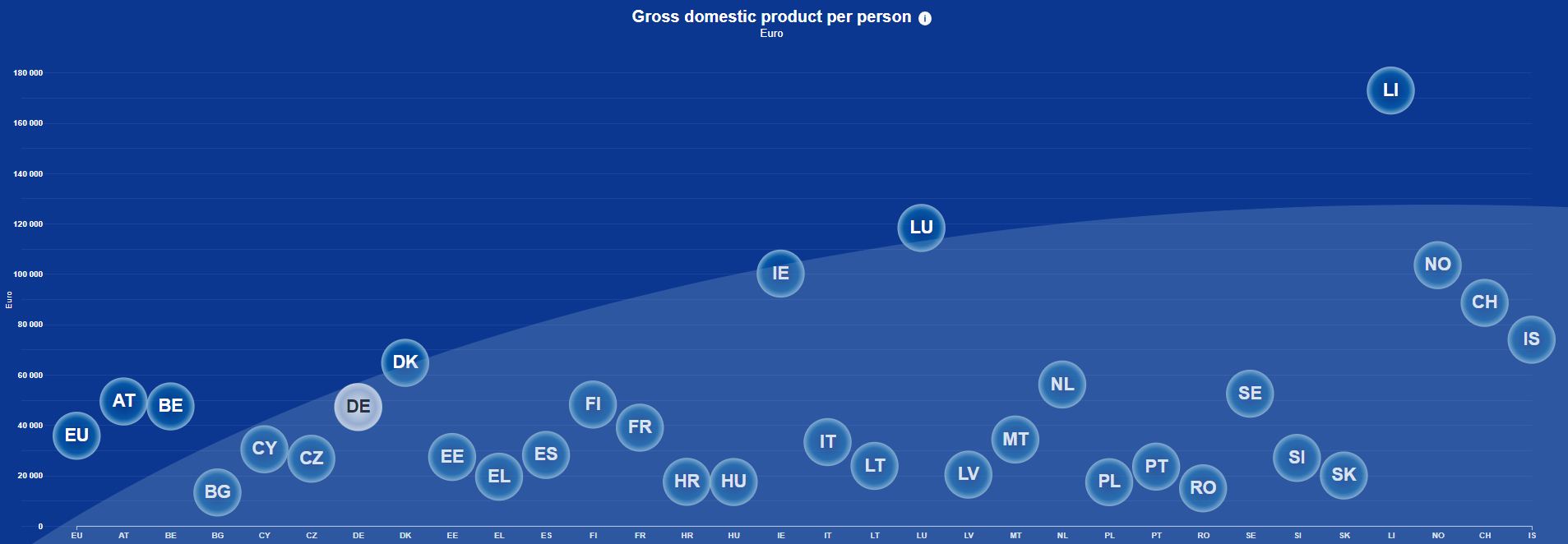

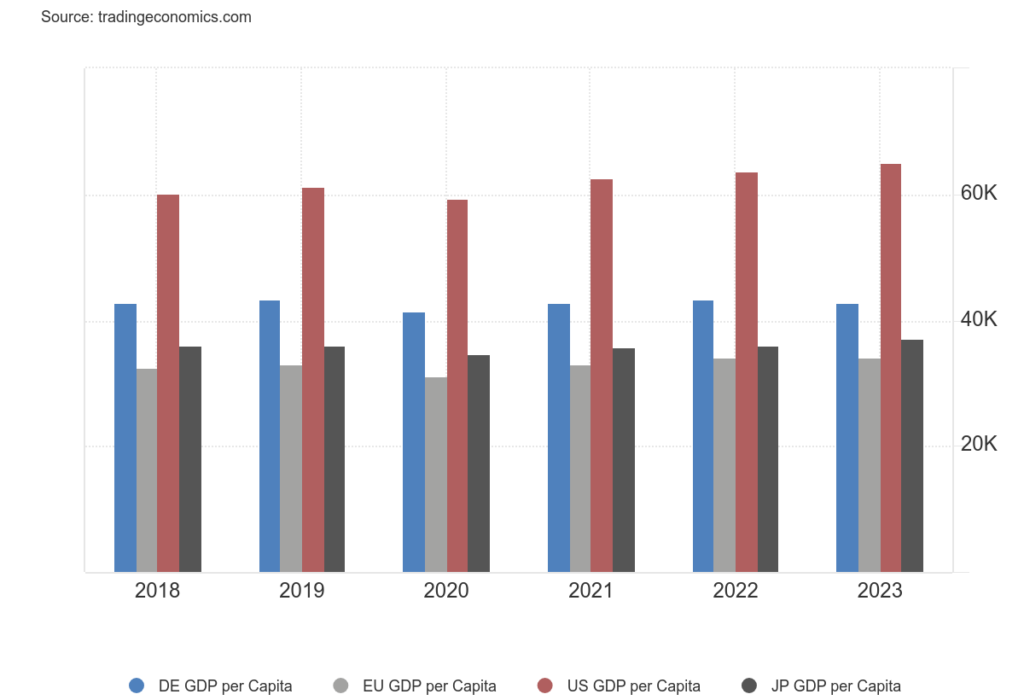

Germany’s GDP per capita was $43,000 in 2023, placing it among the top 20 globally.

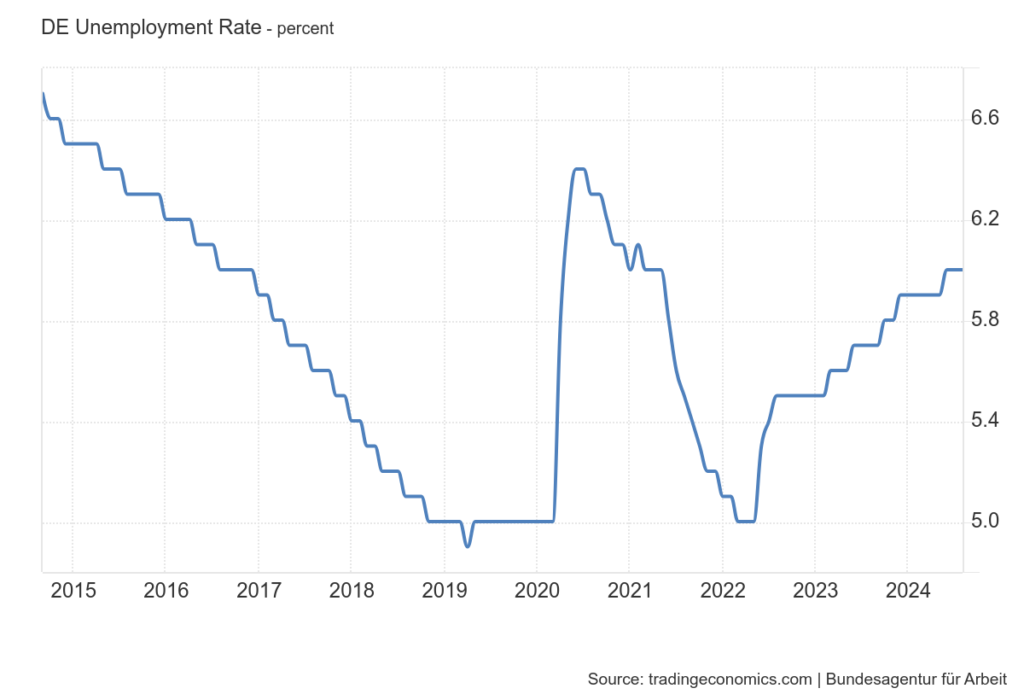

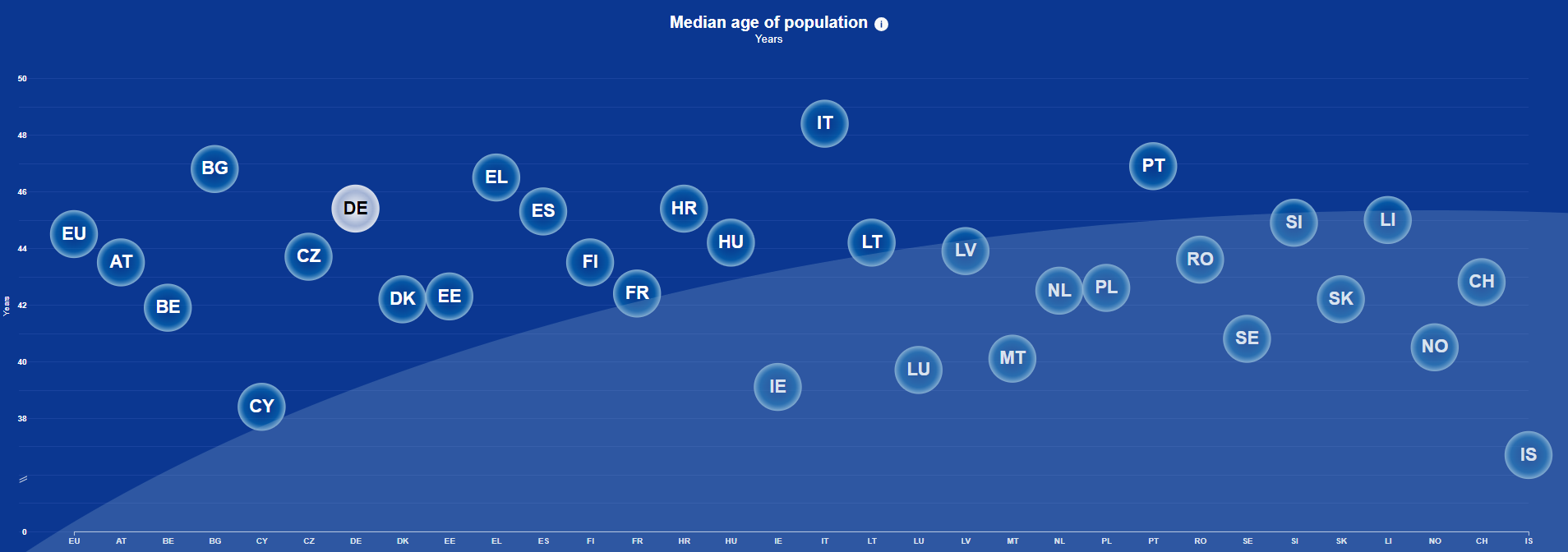

Germany’s labor market remains relatively robust, with an unemployment rate of around 6% as of mid-2024. However, the country faces demographic challenges, including an aging population and a shrinking workforce, which could impact long-term economic sustainability.

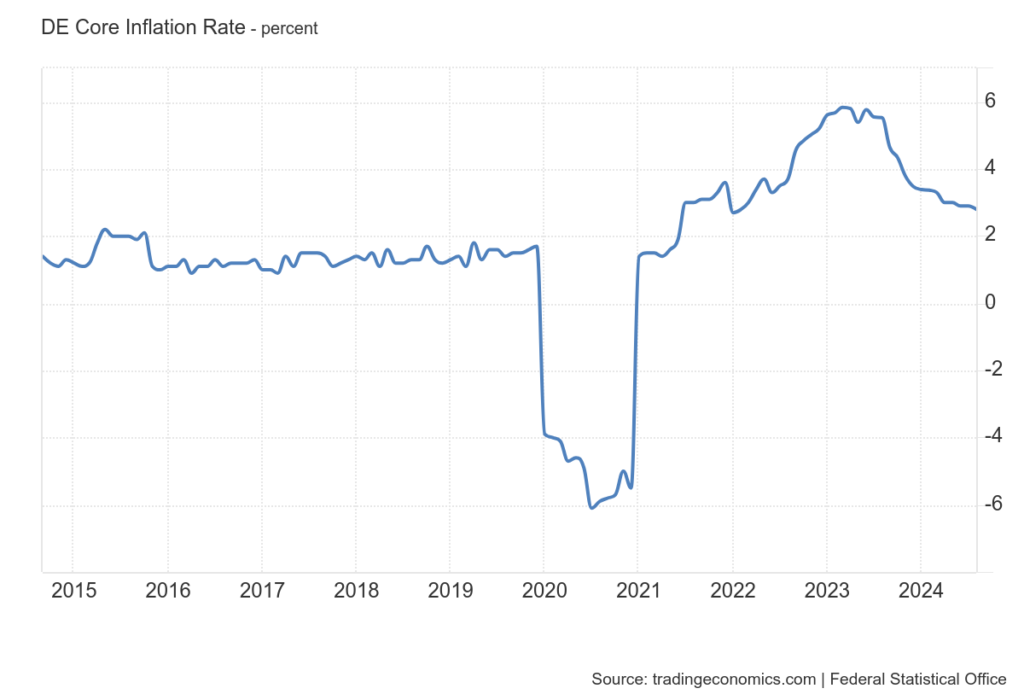

To stimulate growth post-pandemic, the government increased spending, which led to a rise in inflation.

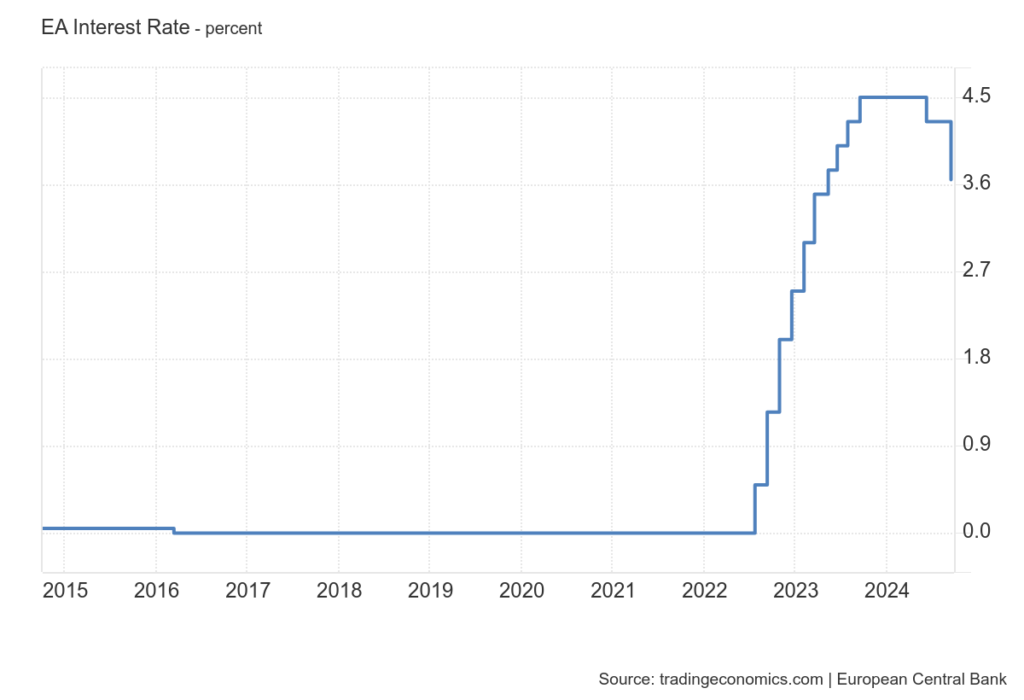

In 2022, inflation peaked. However, with measures implemented by the government and the EU, inflation began to decrease to more manageable levels. The European Central Bank subsequently started to lower interest rates as inflation declined, to support growth and employment.

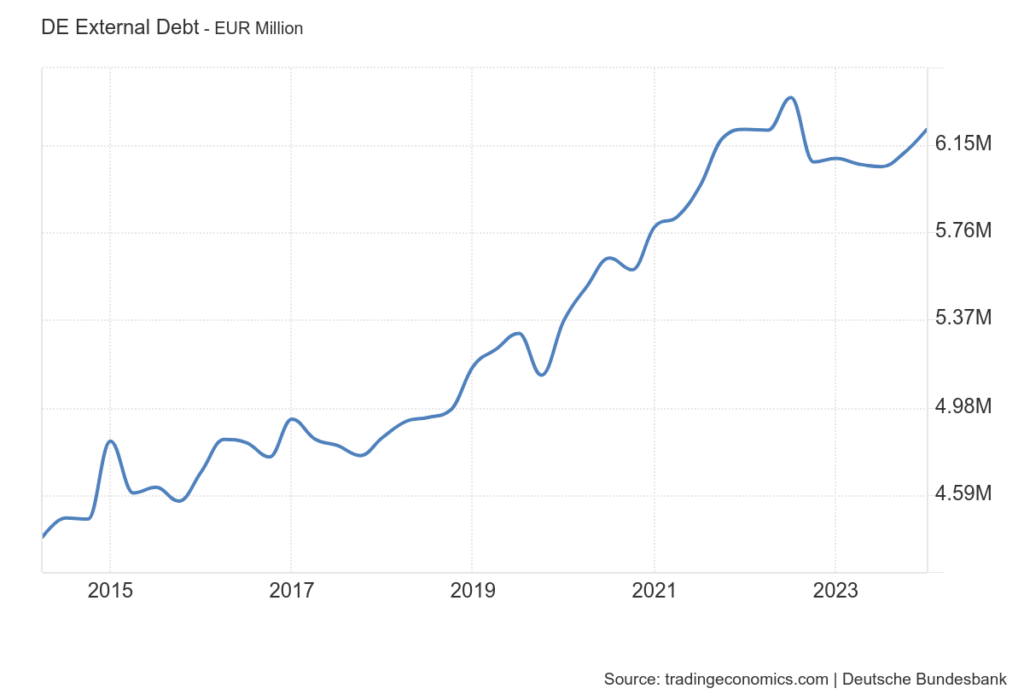

External debt is the money borrowed from foreign countries which includes banks, governments and financial institutions.

According to World Bank Policy Research Working Paper 10475 report on June 2023, global external debt as a share of GDP reached 114% in 2020.

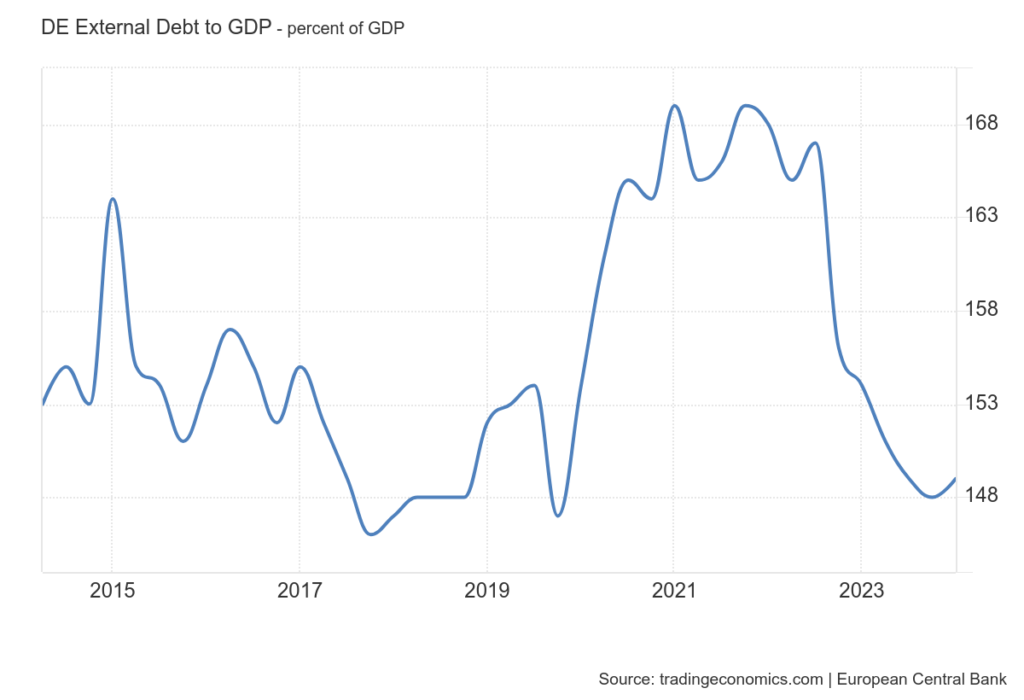

Germany’s external debt stands at 6 trillion EUR, with a debt-to-GDP ratio of 150%. This high ratio presents a financial risk for the country’s future economic stability.

PMI(Purchasing Managers’ Index) is one of the important indices that show the economic activity expectations for the future. Above 50 is considered as good sign for the country.

Germany’s manufacturing PMI has been below 50 for the last few months, suggesting a pessimistic outlook for the economy.

Conclusion

The German economy is at a pivotal point, facing both short-term headwinds and long-term structural challenges. While growth is expected to remain modest in the near term, strategic investments in technology, infrastructure, and green energy could lay the groundwork for sustainable growth in the future. Policymakers will need to balance these priorities while addressing immediate economic pressures to ensure Germany’s continued economic resilience.

For more, explore the France economic outlook